Global Crude Oil Production: A Look at the Major Players

Crude oil remains a cornerstone of the global economy, powering industries, transportation, and daily life worldwide. Its production, distribution, and pricing are influenced by a complex interplay of geological factors, geopolitical events, economic trends, and technological advancements.

The top crude oil-producing countries wield significant influence over global energy markets, and shifts in their output can have far-reaching economic and political implications.

In recent years, the landscape of crude oil production has seen notable developments. The United States has solidified its position as the world's leading crude oil producer, primarily due to the shale revolution. Other major producers like Saudi Arabia and Russia continue to be pivotal players, often influencing global supply through their production policies, particularly within the OPEC+ alliance.

Top Crude Oil Producing Countries (2023 Data)

The following table presents the leading crude oil-producing countries based on available data for 2023. It's important to note that production figures can fluctuate due to various factors, including market demand, geopolitical decisions, and operational capacities.

| Rank | Country | Crude Oil Production (Million Barrels per Day) | Share of World Total (%) |

| 1 | United States of America | 12.93 | ~15.8% |

| 2 | Russia | 10.12 | ~12.4% |

| 3 | Saudi Arabia | 9.73 | ~11.9% |

| 4 | Canada | 4.59 | ~5.6% |

| 5 | Iraq | 4.34 | ~5.3% |

| 6 | China | 4.18 | ~5.1% |

| 7 | Iran | 3.63 | ~4.4% |

| 8 | Brazil | 3.40 | ~4.2% |

| 9 | United Arab Emirates | 3.39 | ~4.1% |

| 10 | Kuwait | 2.71 | ~3.3% |

| World Total (approx.) | 81.78 | 100% |

Note: Data for "Crude Oil including lease condensate production" for 2023. Percentages are approximations based on the world total.

Key Trends and Market Dynamics

The global crude oil market is characterized by several key trends:

- Non-OPEC+ Growth: While OPEC+ (Organization of the Petroleum Exporting Countries and its allies) plays a significant role in managing supply, growth in crude oil production has increasingly been driven by non-OPEC+ countries, particularly the United States, Canada, Brazil, and Guyana.

- Geopolitical Influence: Geopolitical events, such as conflicts, sanctions, and political instability in oil-producing regions, continue to have a profound impact on supply and prices.

- Demand Evolution: Global oil demand is influenced by economic growth, particularly in emerging economies, and the ongoing energy transition towards renewable sources. While overall oil consumption continues to grow, the pace of growth is slowing.

- Price Volatility: Crude oil prices remain susceptible to significant volatility, influenced by supply-demand dynamics, inventory levels, macroeconomic indicators, and market sentiment.

- Investment in the Sector: Capital expenditure in the oil and gas sector is expected to continue growing, driven by the need to maintain existing production and develop new projects.

Economic Implications

The production and pricing of crude oil have substantial economic implications globally:

- Economic Growth: Oil is a critical input for transportation and industrial production. Higher oil prices can increase production and transportation costs, potentially slowing economic activity, while lower prices can provide a stimulus.

- Inflation: As a fundamental component in the production of goods and services, fluctuations in crude oil prices directly impact inflation rates.

- Government Revenues and Fiscal Policies: Oil-exporting nations heavily rely on crude oil revenues, making their economies sensitive to price volatility. Oil-importing countries, on the other hand, face challenges from increased energy costs.

- International Trade and Balance of Payments: Oil prices influence currency values and international trade patterns, affecting the balance of payments for both exporting and importing nations.

The crude oil market remains a dynamic and influential force in the world economy. Understanding its key players and trends is essential for comprehending global economic stability and energy security.

In conclusion, the global crude oil production landscape is a complex and ever-evolving mosaic. The dominance of a few key players, coupled with the intricate web of geopolitical factors, technological advancements, and shifting global demand, ensures that the crude oil market will remain a critical determinant of economic stability and international relations for the foreseeable future. As the world navigates the dual challenges of energy security and the transition to a more sustainable future, the strategies and output decisions of these leading oil-producing nations will continue to be closely watched and profoundly impactful.

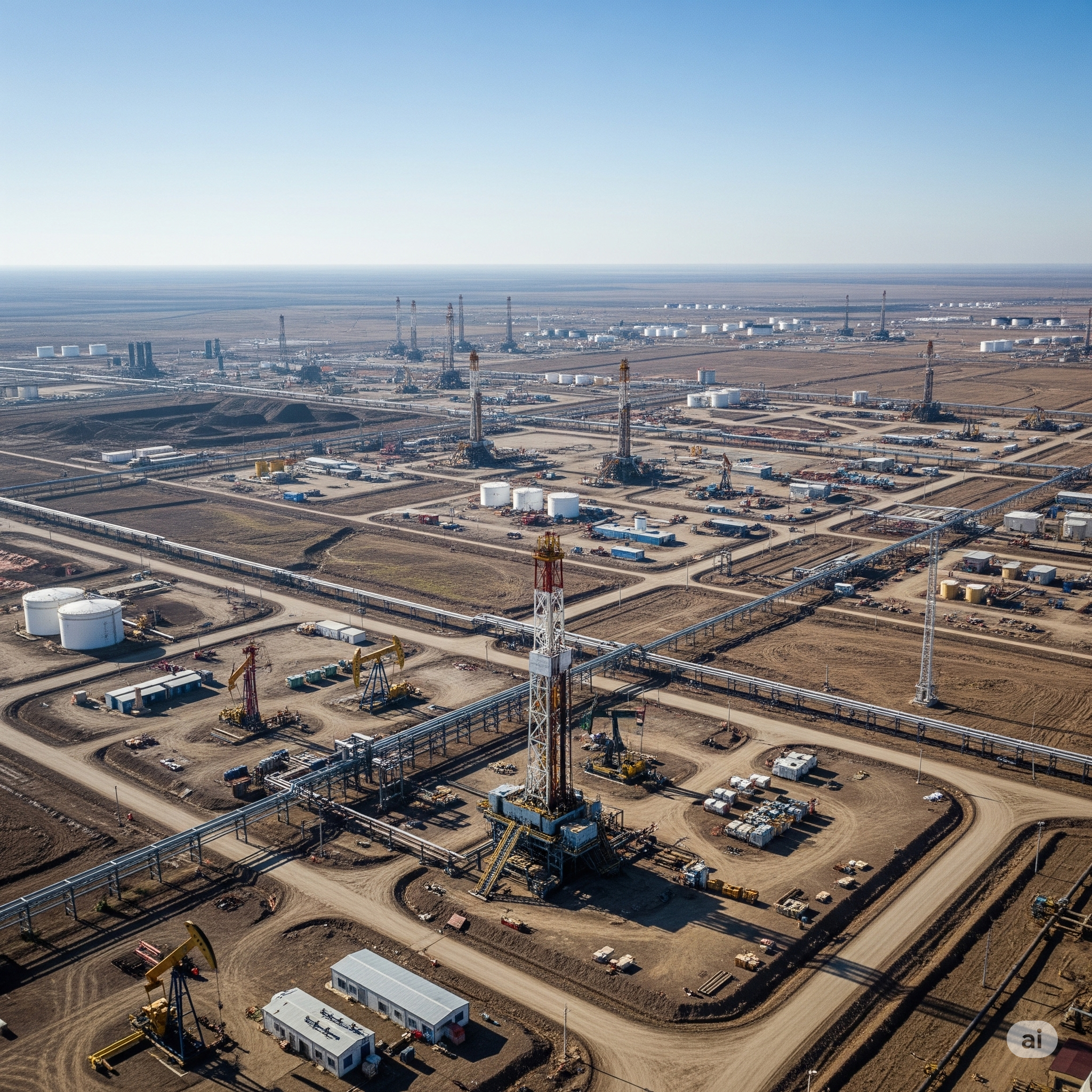

Crude Oil Production in the United States

The United States has emerged as the world's leading crude oil producer in recent years, a remarkable transformation largely driven by advancements in horizontal drilling and hydraulic fracturing techniques. This "shale revolution" has unlocked vast reserves previously deemed uneconomical, significantly impacting domestic energy security and global oil markets. Understanding crude oil production within the U.S. requires a closer look at its key producing regions and the trends shaping its output.

Major Crude Oil Producing Regions in the United States (2023 Data)

Crude oil production in the U.S. is concentrated in several key regions, each with its unique geological characteristics and production dynamics. The following table highlights the major producing areas and their estimated contributions in 2023:

| Rank | Region/Basin | Key States Involved | Estimated Crude Oil Production (Million Barrels per Day) | Significance |

| 1 | Permian Basin | Texas, New Mexico | ~5.8 - 6.0 | The most prolific oil-producing region in the U.S., accounting for a significant portion of total output and driving much of the recent growth. |

| 2 | Gulf of Mexico (Federal Offshore) | Louisiana, Texas, Alabama, Mississippi | ~1.7 - 1.8 | A long-established offshore production area, contributing a substantial and relatively stable volume of crude oil. |

| 3 | Bakken Formation | North Dakota, Montana | ~1.1 - 1.2 | A major shale oil play that experienced rapid growth earlier in the shale revolution. |

| 4 | Eagle Ford Shale | Texas | ~1.1 - 1.2 | Another significant shale oil play in South Texas, contributing substantially to overall production. |

| 5 | DJ Basin | Colorado, Wyoming, Nebraska | ~0.5 - 0.6 | A smaller but still important onshore basin with both conventional and unconventional (shale) production. |

| 6 | Anadarko Basin | Oklahoma, Texas, Kansas | ~0.4 - 0.5 | A mature basin with a long history of oil and gas production, now seeing renewed activity through unconventional drilling. |

| Total U.S. (approx.) | Various | ~12.93 | Represents the overall crude oil production for the United States. |

Note: Production figures are estimates based on available data and may vary slightly depending on the source and reporting period. "Crude Oil including lease condensate production" is the standard measure.

Key Trends and Production Dynamics

Several key trends and dynamics characterize crude oil production in the United States:

- Shale Dominance: Unconventional resources, particularly shale oil from basins like the Permian, Bakken, and Eagle Ford, now constitute the majority of U.S. crude oil production.

- Technological Innovation: Continuous advancements in drilling and completion techniques, such as longer laterals and improved hydraulic fracturing, have enhanced well productivity and reduced costs.

- Permian Basin Growth: The Permian Basin has been the primary driver of U.S. oil production growth in recent years, attracting significant investment and accounting for an increasing share of national output.

- Offshore Production Stability: The Gulf of Mexico remains a significant and relatively stable source of crude oil, with ongoing exploration and development activities.

- Market Responsiveness: U.S. oil producers, particularly independent shale operators, tend to be relatively responsive to price signals, adjusting drilling activity based on market conditions.

- Environmental Considerations: The rapid growth of shale oil production has also raised environmental concerns related to water usage, wastewater disposal, methane emissions, and seismic activity, leading to increased regulatory scrutiny.

- Infrastructure Development: The surge in oil production, particularly in the Permian Basin, has necessitated significant investments in pipeline infrastructure to transport crude oil to refining centers and export terminals.

Economic and Strategic Significance

Crude oil production plays a vital role in the U.S. economy and its strategic standing:

- Economic Growth and Job Creation: The oil and gas industry supports a significant number of jobs and contributes substantially to economic activity at the local, regional, and national levels.

- Energy Security: Increased domestic oil production has significantly reduced U.S. reliance on foreign oil imports, enhancing energy security.

- Global Influence: As the world's leading oil producer, the U.S. holds significant influence in global energy markets and geopolitical discussions.

- Trade Balance: Increased crude oil and petroleum product exports have positively impacted the U.S. trade balance.

Understanding the regional distribution and underlying trends in U.S. crude oil production is crucial for analyzing domestic energy markets, forecasting future production levels, and assessing the nation's role in the global energy landscape.

Crude Oil Production in Russia

Russia stands as one of the world's largest crude oil producers, playing a crucial role in global energy supply and wielding significant influence over international energy markets. Its vast reserves and extensive infrastructure have historically positioned it as a key player in the global oil landscape. Understanding Russia's crude oil production involves examining its key producing regions, the major companies involved, and the factors currently shaping its output.

Major Crude Oil Producing Regions in Russia (Estimated 2023 Data)

Russian crude oil production is geographically concentrated in several key regions. While precise regional breakdowns can be challenging to obtain and may fluctuate, the following table highlights the major areas contributing to the nation's output in 2023:

| Rank | Region/Area | Key Production Centers/Characteristics | Estimated Crude Oil Production (Million Barrels per Day) | Significance |

| 1 | West Siberia | Khanty-Mansi Autonomous Okrug, Yamalo-Nenets Autonomous Okrug; mature fields, significant infrastructure. | ~6.0 - 6.5 | Historically the backbone of Russian oil production, still accounting for the largest share despite some decline in older fields. |

| 2 | Volga-Urals Region | Tatarstan, Bashkortostan, Samara Oblast; older, conventional fields, ongoing enhanced oil recovery efforts. | ~1.5 - 2.0 | A historically significant oil-producing region, production is generally more stable, with efforts to maximize recovery from existing fields. |

| 3 | Eastern Siberia | Krasnoyarsk Territory, Irkutsk Oblast, Sakha Republic (Yakutia); newer fields, challenging Arctic conditions. | ~0.8 - 1.2 | An area with growing production potential, including the Vankor field, facing logistical and climatic challenges. |

| 4 | Timan-Pechora Basin | Komi Republic, Nenets Autonomous Okrug; diverse geological structures, significant reserves. | ~0.6 - 0.8 | A significant producing region in Northwest Russia, with both onshore and offshore (Barents Sea) potential. |

| 5 | North Caucasus | Chechnya, Dagestan, Stavropol Krai; smaller, often older fields. | ~0.4 - 0.5 | A region with a long history of oil production, although its overall contribution is smaller compared to other major areas. |

| 6 | Sakhalin Island (Offshore & Onshore) | Far East Russia; significant offshore projects, often with international partnerships. | ~0.3 - 0.4 | Important for its offshore production and its proximity to Asian markets. Projects often involve advanced technologies for challenging environments. |

| Total Russia (approx.) | Various | ~10.12 | Represents the overall crude oil production for Russia. Note that this figure has been subject to fluctuations due to geopolitical factors in 2022-2023. |

Note: Production figures are estimates based on available information and industry analysis for 2023. Precise regional data can be proprietary and subject to change.

Key Trends and Production Dynamics

Several key trends and dynamics influence crude oil production in Russia:

- West Siberian Dominance: Despite the development of new fields in Eastern Siberia and other regions, West Siberia remains the core of Russia's oil production.

- Mature Fields and Enhanced Oil Recovery (EOR): A significant portion of Russia's oil fields are mature, necessitating the use of EOR techniques to maintain production levels.

- Role of Major Oil Companies: Rosneft, Lukoil, Gazprom Neft, and Surgutneftegaz are the dominant players in Russia's oil industry, controlling the majority of production and reserves.

- Arctic and Offshore Development: Russia has been actively pursuing oil and gas development in the Arctic region and offshore areas, presenting both opportunities and technological challenges.

- Geopolitical Influences: International sanctions and geopolitical events have significantly impacted Russia's oil production, exports, and relationships with international partners in recent years.

- OPEC+ Cooperation: Russia is a key member of the OPEC+ agreement, coordinating production levels with other major oil-producing nations to influence global supply and prices.

- Infrastructure Constraints: While Russia possesses an extensive pipeline network, further development in remote regions requires significant infrastructure investment.

Economic and Strategic Significance

Crude oil production is of paramount economic and strategic importance to Russia:

- Major Source of Revenue: Oil and gas exports constitute a significant portion of Russia's government revenue and foreign exchange earnings.

- Influence on Global Energy Markets: As one of the top global producers, Russia's production decisions and export policies have a substantial impact on global oil prices and supply.

- Geopolitical Leverage: Oil and gas supply has historically been a tool of foreign policy and geopolitical influence for Russia.

- Domestic Employment: The oil and gas sector provides significant employment opportunities across the country.

The crude oil production landscape in Russia is currently navigating a complex period marked by geopolitical tensions and evolving global energy dynamics. Understanding its regional production centers, key players, and the factors influencing its output is crucial for comprehending the global energy balance and future trends.

Crude Oil Production in Saudi Arabia

Saudi Arabia is a global powerhouse in crude oil production and exports, holding the world's second-largest proven crude oil reserves. The country's oil industry is dominated by Saudi Aramco, the national oil company, which manages vast resources and operations across the upstream, midstream, and downstream segments of the energy sector.

Key Aspects of Saudi Arabian Crude Oil Production:

- Global Significance: Saudi Arabia is consistently one of the top crude oil producers and the largest oil exporter globally. Its production levels significantly influence the international oil market and global supply dynamics.

- Major Oil Fields: The Kingdom is home to some of the world's largest oil fields.

- Ghawar Field: The largest conventional onshore oil field globally, accounting for a substantial portion of Saudi Arabia's cumulative oil production.

- Safaniya Field: The world's largest offshore oil field.

- Other significant fields include Khurais, Shaybah, Manifa, Zuluf, and Abqaiq.

- Crude Oil Grades: Saudi Arabia produces various grades of crude oil, generally classified as sour due to their sulfur content. These include Arabian Heavy, Arabian Medium, Arabian Light, Arabian Extra Light, and Arabian Super Light.

- Production Capacity: Saudi Aramco has a stated maximum sustainable capacity of 12 million barrels per day (b/d) and has historically demonstrated the ability to ramp up or cut production in response to market conditions, often in coordination with OPEC+ agreements.

- Recent Trends and Future Outlook: Saudi Arabia's crude oil production has seen fluctuations due to OPEC+ production cuts aimed at balancing the market. While the country had plans to expand its crude oil production capacity to 13 million b/d by 2027, Saudi Aramco halted these plans in January 2024, maintaining the 12 million b/d capacity as its target. Investment continues in key fields like Marjan, Berri, and Zuluf to maintain this maximum sustainable capacity.

- Economic Diversification: Recognizing its reliance on oil, Saudi Arabia is actively pursuing Vision 2030, a plan to diversify its economy and reduce dependence on hydrocarbon revenues by boosting the private sector and investing in non-oil sectors like renewables, tourism, and technology.

Saudi Arabia Crude Oil Production (Thousand Barrels per Day)

| Year | Production (Thousand Barrels/Day) | Change (%) |

| 2010 | 8,900.00 | 7.88% |

| 2011 | 9,458.00 | 6.27% |

| 2012 | 9,832.00 | 3.95% |

| 2013 | 9,693.00 | -1.41% |

| 2014 | 9,735.30 | 0.44% |

| 2015 | 10,045.60 | 3.19% |

| 2016 | 10,461.30 | 4.14% |

| 2017 | 9,969.80 | -4.70% |

| 2018 | 10,311.30 | 3.42% |

| 2019 | 9,829.10 | -4.70% |

| 2020 | 9,190.00 | -6.50% |

| 2021 | 9,125.00 | -0.71% |

| 2022 | 10,588.50 | 16.04% |

| 2023 | 9,612.58 | -9.22% |

| 2024 (projected) | 8,988.48 | -6.50% |

| 2025 (projected) | 9,595.58 | 6.75% |

Note: Production figures can vary slightly across different sources due to reporting methodologies and inclusions (e.g., crude only, or crude + condensates and NGLs). The table above provides annual averages based on available data, primarily from IndexMundi and FRED (St. Louis Fed).

Saudi Arabia's strategic position in the global energy market is underscored by its vast reserves and its role in OPEC+, allowing it to significantly influence global oil supply and prices. The ongoing diversification efforts aim to build a more resilient economy for the future.

Crude Oil Production in Canada

Canada is a major global player in crude oil production, ranking as the world's fourth-largest oil producer and fourth-largest exporter. The country boasts the third-largest proven oil reserves globally, with the vast majority found in the oil sands of Alberta. Canada's oil industry is a critical component of its economy, though it also faces ongoing discussions regarding environmental impact and transportation infrastructure.

Key Aspects of Canadian Crude Oil Production:

- Dominance of Oil Sands: Over 95% of Canada's proven oil reserves are located in the oil sands (also known as tar sands) deposits, primarily in Alberta. This unconventional resource requires specialized extraction methods.

- Mining: Used for shallower deposits (less than 75 meters underground), where large shovels and trucks extract the oil sand, which is then processed with hot water to separate the bitumen.

- In-situ Extraction: Employed for deeper deposits, with Steam Assisted Gravity Drainage (SAGD) being the most common method. This involves injecting steam into wells to thin the bitumen, allowing it to flow to a lower well and be pumped to the surface.

- Crude Oil Types: Canada produces various types of crude oil:

- Bitumen: The very thick, viscous form of oil extracted from the oil sands. It needs to be diluted with lighter hydrocarbons (like condensates) to become "dilbit" for pipeline transport or upgraded into Synthetic Crude Oil (SCO).

- Synthetic Crude Oil (SCO): A lighter, less viscous crude produced by upgrading bitumen.

- Conventional Crude Oil: Includes light, medium, and heavy crude oil extracted from traditional wells.

- Western Canadian Select (WCS): A benchmark heavy sour crude blend from Western Canada, often sold at a discount to lighter crudes like West Texas Intermediate (WTI) due to its quality and transportation costs.

- Major Producing Regions:

- Alberta: The overwhelming leader, accounting for around 84% of Canada's total crude oil production in 2023, almost entirely due to its oil sands.

- Saskatchewan: A significant producer, primarily of conventional heavy oil.

- Newfoundland and Labrador: Produces offshore conventional crude oil.

- Other provinces with smaller contributions include British Columbia, Manitoba, Northwest Territories, and Ontario.

- Export-Oriented Industry: Canada produces significantly more oil than it consumes domestically. The vast majority (nearly 80% in 2023) of its crude oil is exported, with almost all of it going to the United States. The Trans Mountain pipeline expansion, operational in May 2024, is increasing Canada's ability to access Pacific Ocean terminals and export to Asian markets.

- Infrastructure: Extensive pipeline networks transport Canadian crude, notably the Enbridge Mainline system, TC Energy's Keystone Pipeline, and the Trans Mountain Pipeline. Rail and marine transport also play a role.

Canada Crude Oil Production (Thousand Barrels per Day)

| Year | Production (Thousand Barrels/Day) | Change (%) |

| 2010 | 3,184.00 | - |

| 2011 | 3,366.00 | 5.71% |

| 2012 | 3,640.00 | 8.14% |

| 2013 | 3,845.00 | 5.63% |

| 2014 | 4,204.00 | 9.34% |

| 2015 | 4,251.00 | 1.12% |

| 2016 | 4,409.00 | 3.72% |

| 2017 | 4,677.00 | 6.08% |

| 2018 | 4,817.00 | 3.00% |

| 2019 | 4,707.00 | -2.28% |

| 2020 | 4,374.00 | -7.07% |

| 2021 | 4,690.00 | 7.23% |

| 2022 | 5,014.00 | 6.91% |

| 2023 | 5,110.00 | 1.91% |

| 2024 (projected) | 5,200 - 5,400 est. | 1.76% - 5.67%* |

Note: Data primarily sourced from Natural Resources Canada, Statistics Canada, and EIA. Production figures often include crude oil and equivalent products (condensate and pentanes plus). Projections for 2024 are based on market analyst estimates for annual growth.

As two of the world's leading crude oil producers, Saudi Arabia and Canada play indispensable roles in shaping global energy markets. While Saudi Arabia leverages its vast conventional reserves and strategic position within OPEC+ to influence supply and pricing, Canada's growth is predominantly driven by its expansive oil sands, necessitating innovative extraction technologies and robust export infrastructure. Both nations face evolving dynamics, balancing the imperatives of energy security and economic prosperity with the growing global emphasis on energy transition and climate action. Their continued contributions, along with their respective approaches to energy diversification and sustainability, will remain crucial factors in the future of the international energy landscape.

Crude Oil Production in Iraq

Iraq stands as a pivotal nation in the global crude oil market, holding the world's fifth-largest proven oil reserves. Its oil industry is the lifeblood of its economy, with oil revenues consistently accounting for over 99% of exports, a significant portion of the government's budget, and a substantial share of its GDP. As a founding member and the second-largest producer within OPEC, Iraq's production and export policies have a considerable impact on international oil supply and prices.

Key Aspects of Iraqi Crude Oil Production:

- Vast Reserves: Iraq's proven oil reserves are estimated at around 145 billion barrels, concentrated in giant and super-giant fields, predominantly in the southern region. These fields are characterized by low production costs and high recovery rates.

- Major Oil Fields:

- Rumaila: One of the largest oil fields in the world, located in southern Iraq.

- West Qurna (1 & 2): Massive fields in the south, undergoing significant development.

- Majnoon: Another super-giant field in the south, known for its vast potential.

- Halfaya: A major field in Maysan province.

- Kirkuk: A historically significant field in the north, though production has faced challenges due to regional complexities.

- Other important fields include Zubair, Garraf, and Nasiriyah.

- Production Growth and Challenges: Despite its immense potential, Iraq's oil sector has faced significant challenges over decades, including wars, sanctions, and political instability, which have hampered investment and infrastructure development. However, since the early 2000s, Iraq has seen substantial growth in production, driven by foreign investment and the rehabilitation of its oil fields.

- Export Infrastructure: The majority of Iraq's crude oil exports flow through its southern ports on the Persian Gulf, primarily via the Basra Oil Terminal and Khor Al-Amaya Oil Terminal. The country is actively investing in expanding its offshore export capacity, including new pipelines and platforms, to accommodate higher production volumes. While the northern Iraq-Turkey Pipeline (ITP) has historically been a significant export route, its operations have faced disruptions due to political disagreements between Baghdad and the Kurdistan Regional Government (KRG).

- OPEC+ Compliance: As a member of OPEC+, Iraq adheres to production quotas set by the alliance. While Iraq has sometimes faced challenges in consistently meeting its compliance targets due to various factors, there is ongoing pressure and efforts to improve adherence to these agreements.

- Economic Dependence and Diversification: Iraq's heavy reliance on oil revenues makes its economy vulnerable to fluctuations in global oil prices. The Iraqi government is pursuing efforts to diversify its economy and reduce this dependence, though the oil sector remains paramount for national revenue and development.

Iraq Crude Oil Production (Thousand Barrels per Day)

| Year | Production (Thousand Barrels/Day) | Change (%) |

| 2010 | 2,399 | - |

| 2011 | 2,626 | 9.46% |

| 2012 | 2,983 | 13.60% |

| 2013 | 3,055 | 2.41% |

| 2014 | 3,370 | 10.31% |

| 2015 | 4,055 | 20.33% |

| 2016 | 4,452 | 9.79% |

| 2017 | 4,466 | 0.31% |

| 2018 | 4,623 | 3.51% |

| 2019 | 4,720 | 2.10% |

| 2020 | 4,088 | -13.39% |

| 2021 | 4,085 | -0.07% |

| 2022 | 4,471 | 9.45% |

| 2023 | 4,353 | -2.64% |

| 2024 (projected) | 4,423 | 1.61% |

| 2025 (projected) | 3,999 - 4,245 est. | -9.6% - -2.5%* |

Note: Data primarily sourced from EIA (U.S. Energy Information Administration) and CEIC Data. Figures represent crude oil production and may include condensates. Projections for 2025 are based on recent monthly data and market expectations, considering OPEC+ agreements.

Iraq's future in the oil market hinges on its ability to further stabilize its political environment, attract sustained international investment, and continue developing its vast proven reserves while balancing its commitments within OPEC+.

Conclusion of Global Crude Oil Production

The global crude oil production landscape is a dynamic interplay of geological realities, technological advancements, geopolitical tensions, and shifting demand patterns driven by the energy transition. As evidenced by the detailed analyses of Saudi Arabia, Canada, and Iraq, each major producing nation brings unique characteristics and challenges to the world stage.

Key Takeaways from Leading Producers:

- Saudi Arabia's Enduring Influence: As the de facto leader of OPEC+ and with vast, low-cost conventional reserves, Saudi Arabia remains a critical swing producer. Its capacity and willingness to adjust output significantly impact global supply and price stability. While it faces long-term diversification goals, its short-to-medium term role in meeting global demand is undeniable.

- Canada's Unconventional Might: Canada's position as a top producer is overwhelmingly thanks to its oil sands. This unconventional resource, while technologically intensive and environmentally scrutinized, ensures a substantial and long-term supply. Its challenge lies in optimizing extraction, reducing environmental impact, and expanding export routes to global markets beyond its primary customer, the United States.

- Iraq's Resurgent Potential: Despite decades of conflict, Iraq possesses enormous undeveloped potential with some of the world's largest and most accessible conventional fields. Its ability to ramp up production further, provided political stability and sustained investment, makes it a crucial player in meeting future demand, particularly within the OPEC+ framework.

Overarching Global Trends and Future Outlook:

- OPEC+ as a Stabilizing (and Disrupting) Force: The OPEC+ alliance continues to wield significant influence over global oil supply. Their coordinated production cuts and, at times, unexpected increases, aim to manage market stability and support prices, often in response to demand fluctuations and geopolitical events. The delicate balance of maintaining market share while maximizing revenue is a constant consideration.

- The Rise of Non-OPEC+ Production: Countries outside of OPEC+, particularly the United States (shale), Canada (oil sands), Brazil, and Guyana, are increasingly driving global supply growth. This diversified supply reduces the singular dependence on traditional Middle Eastern producers, adding complexity to market dynamics.

- Geopolitical Volatility: Crude oil production and prices remain highly susceptible to geopolitical events. Conflicts in key producing regions, sanctions, and trade disputes can rapidly disrupt supply chains and inject significant volatility into the market, as seen historically and in recent times.

- Technological Evolution: Advancements in drilling techniques (e.g., horizontal drilling, hydraulic fracturing), seismic imaging, automation, and data analytics continue to unlock previously inaccessible or uneconomical reserves, enhancing production efficiency and potentially expanding the global supply base.

- Shifting Demand Narratives: The long-term outlook for oil demand is subject to intense debate. While some forecasts predict a peak in global oil demand by 2030 or 2035 due to the energy transition and the rise of electric vehicles, others foresee continued growth, especially in non-OECD economies like India, Africa, and parts of Asia, driven by economic development and transportation needs. The pace of decarbonization efforts will be a key determinant.

- Investment Imperatives: To meet anticipated future demand, significant new investments in exploration and production remain essential, even under various energy transition scenarios. However, the uncertainties surrounding peak demand and environmental policies can create investment reluctance, potentially leading to supply constraints down the line.

In essence, global crude oil production is at a crossroads, balancing the immediate need for energy security and economic growth with the long-term imperative of climate action. The strategies employed by major producers like Saudi Arabia, Canada, and Iraq, alongside technological innovation and geopolitical stability, will critically determine the future trajectory of the world's most vital commodity.